Identifying Brand Values for the New American Middle Consumer

Ever since we identified the market opportunity that is the New American Middle, we’ve worked on adding precision and narrowing down the markup of this consumer supergroup—a group that is driven by psychographic overlaps, not by demographic attributes.

This emphasis on a more contextual and holistic definition lends complexity to the process of clarifying the guard rails of this audience, yet through our initial secondary research and now, with added primary research, we’re able to make directional assumptions with more confidence than ever.

And we’re just getting started.

Adding Clarity and Definition to NAM Through Primary Research

For more than five years, we’ve been digging, reading, curating, pivoting, and synthesizing secondary data sources that have allowed us to identify similarities and overlap in this consumer group’s core values, how they feel about “big” institutions, the importance of authenticity, the importance of brands that express their values with clarity, and several other similarities that you can read more about on our NAM manifesto.

Our latest round of primary research to gather more information about this consumer supergroup validated a slew of our secondary and directional data points, reaffirmed some of our assumptions, and gave us deeper insights into values, urbanicity, brand preferences, exclusion vs. inclusion, and a whole host of directional data points that we will continue to validate and hone in on with our next batch of primary data.

We wanted to share a few of the biggest aha moments that this research identified—some of the instances where our confidence level is very high and we can get closer to optimal precision.

From a data validation perspective, here are some of the macro insights we’ve gleaned:

- Spirituality and sustainability are more important to single-parent family units than to other family units surveyed (assumptions validated).

- Family is more important to rural populations and environmental consciousness is more important to urban populations (assumptions validated).

- Spirituality matters to a higher degree to the 45–60 age group (assumptions validated).

- Family and environmental consciousness are the top two values held by those living on the East and West Coasts, while family and spirituality are the top values held by those living in the Midwest and southern states (assumptions validated).

- West Coast shoppers are twice as concerned with whether or not a product or service they are purchasing “provides hope” (further research needed).

- East Coast shoppers are less concerned with whether or not a product or service has “wellness” benefits or attributes (further research needed).

- Shoppers in the South are less concerned with the design/aesthetics of a product or service compared to shoppers in other regions (further research needed).

- Individuals who value environmental consciousness, spirituality, and sustainability are less likely to favor big institutions, like banks and corporations (assumptions validated).

- The 45–64-year-old demographic group views large institutions in a more favorable light than other age groups do (assumptions validated).

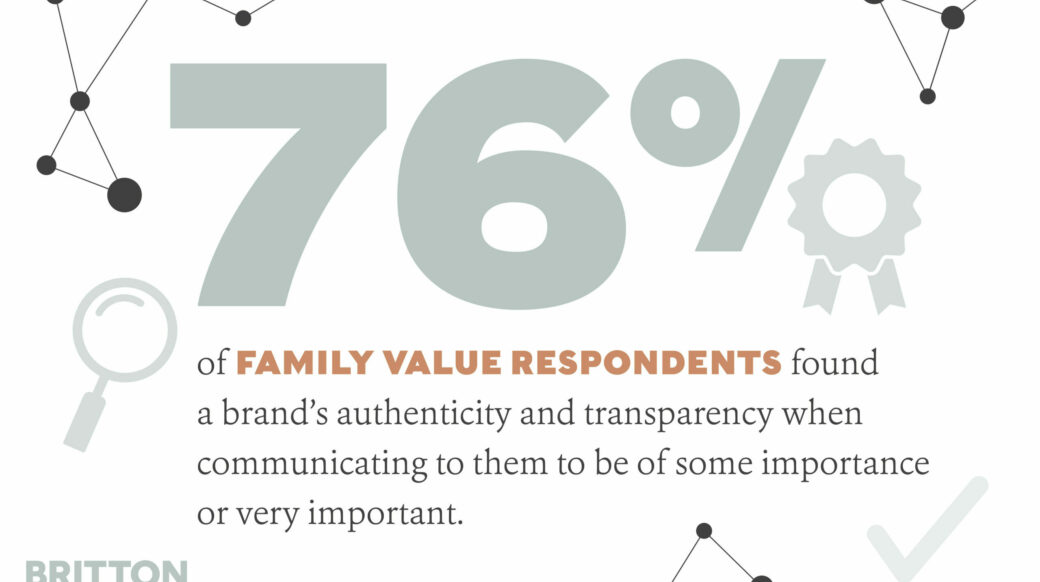

- Individuals who value spirituality and sustainability find it important or very important for brands to be authentic and transparent when communicating with customers (assumptions validated).

- The 18–29 age segment finds brand authenticity and transparency to be very important; they feel much more strongly about this than any other age demographic (assumptions validated).

- Those that value spirituality, faith, and sustainability the most feel they are not being included in diversity and inclusivity conversations by brands (further research needed).

Diving deeper, we synthesized data based on a couple of foundational truths to identify core insights within brand preference, value meaning, product attributes, product preferences, and more. Here’s a contextual look into what these insights have yielded so far: